Recent research conducted by PMG Intelligence, a national market research, and data science company, suggests that Millennials and Gen Z represent a crucial market opportunity for financial services companies.

This article advocates for financial services companies to develop focused growth strategies to acquire and retain Millennial and Gen Z consumers.

The key pillars supporting this case are as follows:

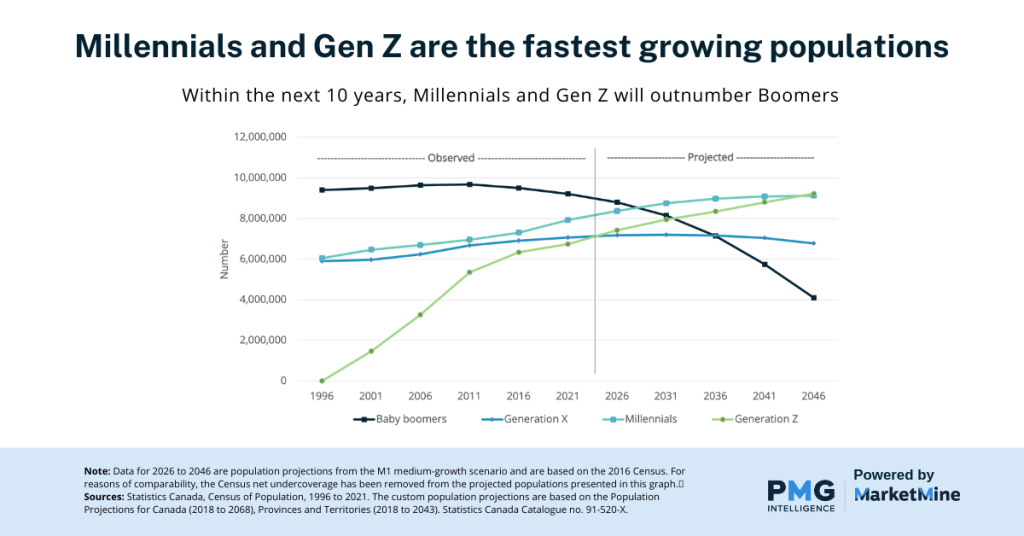

-Millennial and Gen Z demographic segments are poised to surpass Boomers as the largest demographic segment in the near future.

-Millennial and Gen Z financial consumers exhibit higher levels of engagement with their finances and are open to sharing their experiences with family and friends.

-Millennial and Gen Z financial consumers have specific preferences regarding their expectations from financial services companies.

Millennial and Gen Z to Surpass Boomers

In 2021, Boomers represented the largest generation in Canada; however, their demographic influence is waning. Millennials, aged 27 to 42, are the fastest-growing population segment, followed by Generation Z, aged 11 to 26. Population projections indicate that Millennials may become the largest generation in the country as early as 2029. Additionally, Generation Z could outnumber Baby Boomers by 2032 and Millennials by 2045.

Companies that redirect their focus toward Millennials and Gen Z now will be best positioned to attract and retain them as clients and members, thus driving long-term value.

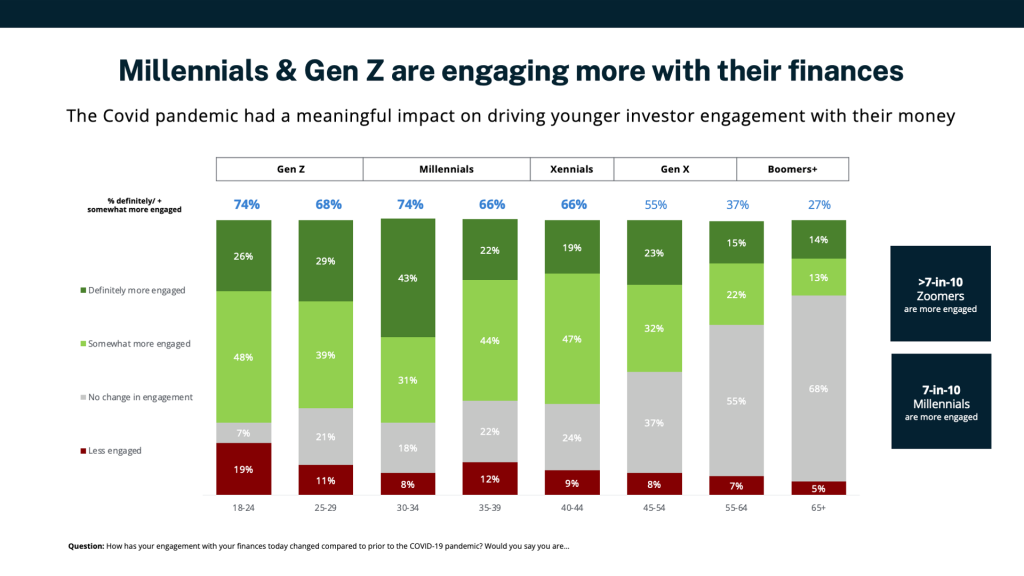

Millennials and Gen Z Are More Engaged in Finances

The COVID-19 pandemic significantly increased engagement with finances among younger generations. Approximately 7 in 10 Millennials and Gen Z individuals acknowledge greater engagement with their finances.

In addition to increased engagement, several other observations regarding Millennials and Gen Z clients and members were noted, including:

-A greater likelihood to discuss money matters with family and friends.

-A strong interest in various financial topics, ranging from basics to more complex products (although receptivity tends to drop after age 35)

-Aspirations for achieving a higher financial status.

-A desire to enjoy their money presently while also focusing on maximizing returns and adhering to socially responsible investment practices.

Moreover, Millennials and Gen Z are increasingly adopting a holistic approach to their financial goals, preferring to work with financial advisors while remaining technologically savvy and adept with digital tools. These characteristics signify an opportunity, as they are receptive to offers that align with their values and expectations.

Millennials and Gen Z Have Specific Preferences

To attract and retain younger generations, companies must cater to their expectations regarding products, client/member experience, and values alignment. PMG suggests the following strategies for financial services companies building focused growth strategies with Millennials and Gen Z:

-Offer promotions and incentives on products and services, available to both new and current clients or members. Prioritize retention efforts alongside acquisition campaigns to maintain loyalty among existing clientele.

-Focus on providing an exceptional onboarding experience, leveraging digital innovation to deliver personalized experiences. This not only creates a positive first impression but also positions the company to highlight the benefits of being a client or member, potentially generating positive word-of-mouth on social media platforms.

-Demonstrate and reinforce corporate values, emphasizing community engagement and purpose beyond economic gains. Companies that showcase care and concern for societal issues are more likely to engage Millennials and Gen Z.

The Bottom Line

The observed behavioural changes and growth rates among Millennial and Gen Z financial consumers underscore the urgency for financial services companies to act now.

Developing a focused strategy to attract and retain younger generations lays the groundwork for long-term success.