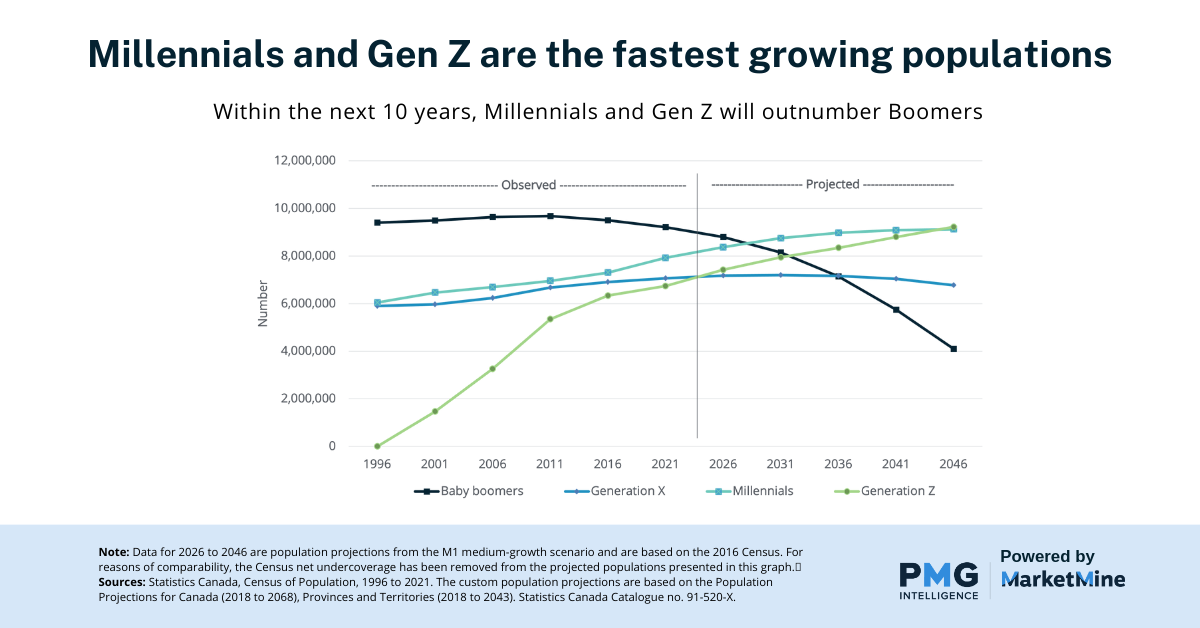

A number of firms are being encouraged to focus on Boomers, the largest generation today. This is motivated primarily by the amount of wealth controlled by them; especially in the near term. But what is the potential impact as the Millennial and Gen Z population surpass Boomers in the next 10 years?

To set the stage, PMG’s 2023 Millennials and Gen Z study identified some key behavioural themes of these growing generations. First, Millennials and Gen Z are not as homogenous as Boomers. Second, their level of engagement with their finances is increasing. Finally, these generations have a greater propensity to refer based on their customer experience. These themes, among other behavioural nuances with Millennials and Gen Z, demand attention from firms. Particularly if you want to secure a role in supporting the largest transfer of intergenerational wealth in history.

Next Generations are no longer Homogeneous

PMG research confirms investors under 40 are inherently different from generations past, not only in their mindsets around their finances but also in the way they want to engage, their expectations from financial services, and the financial products of interest. There are noticeable differences not only between the Millennial and Gen Z divide, but also intra-generationally between those who are early versus latecomers to their respective cohorts. This suggests that financial institutions and advisors need to be mindful in understanding these differences to ensure strategies are reflective of each cohort’s unique perspective toward money and finances.

Engagement is Increasing

The pandemic was an important catalyst for increasing young investor engagement with their finances, and in turn, modern Zoomer and young Millennial investors appear to “want it all”—they are seeking holistic financial management; wanting to manage their finances on their own, but also looking to be supported with a traditional advisory relationship. With this, the research is suggesting the industry is approaching an important tipping point as it relates to advice. While younger investors currently have appetite for both digital and traditional financial relationships, providers of traditional advice appear to be underserving this market, opening the door for digital advice as the preferred proposition. Moreover, younger investors—particularly Gen Z—are growing accustomed to instant access/instant gratification and tend to trust technology more inherently with few barriers. Ensuring younger investors continue to see value in traditional/human expertise early in their financial journey will be increasingly important. Though the industry appears to be effectively capturing younger investor attention, keeping their attention is more challenging.

More Inclined to Refer

Millennial, and particularly Gen Z investors are more apt to provide recommendations to others than prior generations. This drives important considerations to providers/advisors being willing to onboard younger (and potentially lower asset) investors, earlier in their financial life. Those brands willing and able to service and meet younger investor expectations are set to be rewarded.

A firm’s ability to adapt to the behavioural changes of Millennials and Gen Z will drive continued success. Over the next few weeks, we will share more insights from our 2023 Millennials and Gen Z study that make the case to understand the behavioural changes and adapt today in order to be successful tomorrow.

You can unlock this primary study and more with a PMG MarketMine subscription, available to Canadian Financial Institutions.